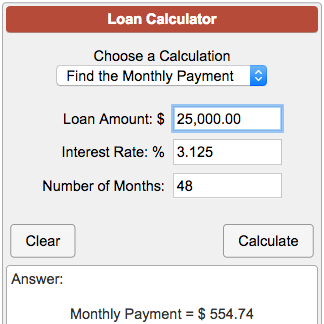

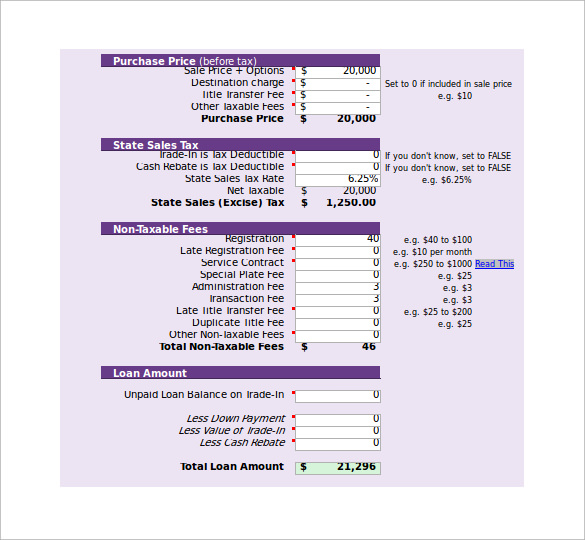

In the olden days, lenders would charge you that full $1,000 to get their due. Nice!īut your lender will be like ummm interest is our income - we’re glad you paid us back what you borrowed, but you’re also kinda stiffing us out of $1,000. Now, if you get a new job and pay off your loan in full in just 18 months, you may save yourself around $1,350 in interest. It may sound baffling or spiteful, but it’s actually just simple economics.Īs illustrated by our auto loan calculator, if you take out a $35,000 loan at 5% interest for 36 months, you’ll end up paying about $2,750 in total interest. What Is a Prepayment Penalty?Ī prepayment penalty is a fee that a lender charges you for paying back your loan before the end of your scheduled loan term (your designated time period for repayment). That said, they may charge you a fee, called a prepayment penalty. After all, any amount of outstanding debt is a risk for them. Generally speaking, lenders won’t stop you from paying them back early. What Happens When You Pay Off a Car Loan Early? Check your loan documents or just give them a call to find out what their process looks like. Most lenders will have a checkbox somewhere to indicate that you’d like extra payments to apply to your principal. So, if you pay $1,000 instead of $500 next month, where does the extra $500 go? Principal or interest?Įvery lender is different, but many will simply see the extra capital and go “gee, thanks!” and apply more of it to interest (i.e., pay themselves).īut you’re allowed (and encouraged) to tell your lender “hey, please apply this to my principal so I can pay off my loan faster.” If I Pay Extra on My Car Loan Does It Go to Principal?Īuto loans are amortized, meaning some of your monthly payment goes to your principal and some goes to interest. Most of the time, though, you’ll be on a simple interest plan - so that’ll be our focus moving forward. For that reason, if you ever consider a precomputed interest loan, you’ll definitely want to ensure that your lender offers an early repayment refund. With precomputed interest, lenders tend to be less concerned with how quickly you pay off your loan since they’re getting the same amount of interest either way. Whether you’re paying simple or precomputed interest will make a difference in your options for early payment.įor simple interest, some lenders will charge you a fee for paying off your loan early since they’ll be missing out on some expected interest aka income. Precomputed interest is all calculated upfront, and the total amount of interest you have to pay your lender doesn’t change even if you start paying off your loan faster. If you start making payments earlier, more frequently, or simply pay more than your monthly payment, your remaining interest should shrink in real-time, allowing you to pay off your loan faster. Simple interest, which the vast majority of lenders use, is calculated using your outstanding balance on the day your payment is due. In your existing and future loan documents, you may also run into two different types of interest: Interest equals income for lenders keep that in mind as we dive further in. Interest is the “fee” charged by the lender for borrowing their money. So if you’re buying a $30,000 car and can make a down payment of $5,000, you’ll be borrowing the other $25,000. Principal is the total amount of money you’re borrowing to buy the car.

#Pay extraon car loan calc pdf#

#Pay extraon car loan calc how to#

0 kommentar(er)

0 kommentar(er)